SC PORTS TURNS TO TRAC, FLEXI-VAN TO HELP LAUNCH CHASSIS POOL

The South Carolina Port Authority will be able to launch its proprietary chassis pool as scheduled in March thanks to a last – minute agreement to secure 5,000 chassis from two major equipment providers.

ILWU, PMA ISSUE UPDATE ON CONTRACT TALKS

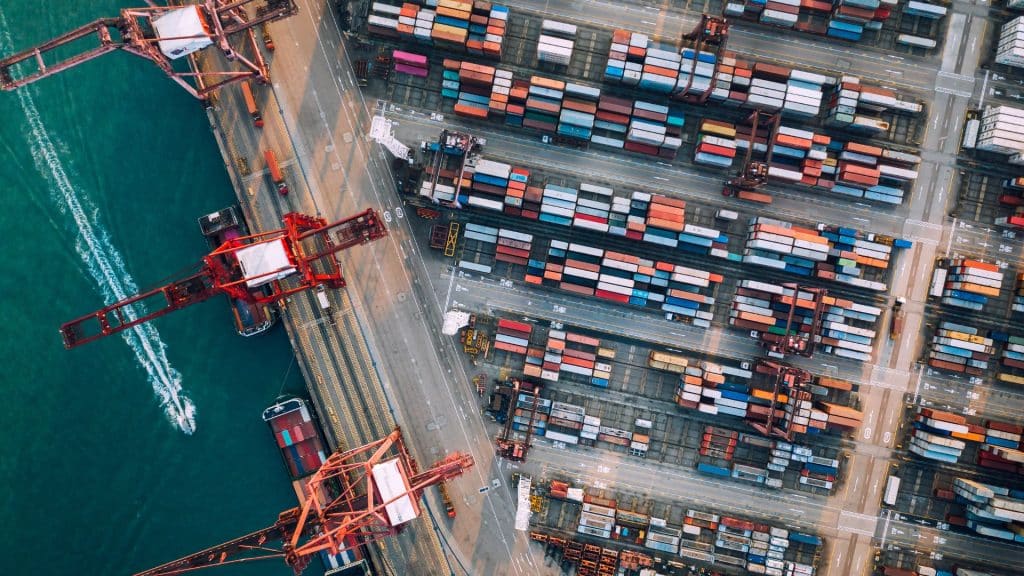

The International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) announced in a joint statement on February 23 that they continue to negotiate and “remain hopeful of reaching a deal soon.” The parties have agreed not to discuss negotiations in the media as collective bargaining continues. Negotiations for a new collective bargaining agreement covering more than 22,000 dockworkers at 29 West Coast ports began on May 10, 2022. The parties have reached a tentative agreement on certain key issues, including health benefits, and remain committed to resolving remaining issues as expeditiously as possible. Talks are continuing on an ongoing basis until an agreement is reached. The announcement comes as the US West Coast ports continue to handle lower volumes relative to the country’s East Coast and Gulf Coast ports, which have benefited from both congestion at the height of the pandemic at the West Coast ports and uncertainty among carriers and shippers as the West Coast labour talks drag on.

PORT HOUSTON SEES SMALL DECLINE IN CONTAINERS BUT CARGO ACTIVITIES STILL ‘SOLID’

Port Houston container volume dipped 1% year over year (y/y) in January to 319,990 twenty-foot equivalent units compared to the same month last year. Imports of steel were up 17% y/y in January at 514,024 tons. Port Houston also saw a 31% y/y growth in export loaded containers, totalling 113,875 TEUs. Full import containers were down 6% y/y in January to 149,400 TEUs. Port Houston owns and operates the Barbours Cut and Bayport container terminals, which have been averaging a combined 63,000 gate transactions per week.

PORT OF NEW ORLEANS RECORDS DECLINES IN CONTAINERS, BREAKBULK CARGO

Top containerized commodities that passed through the port in January were plastics, chemicals, forest products and coffee. Breakbulk cargo totalled 133,403 short tons in January, a 51% y/y decline compared to the same month in 2022, when the port recorded massive shipments of plywood. Steel, rubber and bagged cargo were the top breakbulk cargo commodities during the month. The port handled 14,094 Class I railcar switches in January, a 28% y/y increase. The port handles switching operations for the six Class I railroads that operate in New Orleans: BNSF Railway, CN, CSX, Kansas City Southern, Norfolk Southern and Union Pacific.

PORT OF CORPUS CHRISTI CONTINUES WITH STRONG CRUDE OIL EXPORTS

The Port of Corpus Christi saw a 7% y/y increase in total cargo to 16.4 million tons in January, led by exports of crude oil, petroleum, and dry bulk cargo. The port handled 9.8 million total tons of crude oil during the month, a 10% increase compared to the same year-ago period. Exports of crude oil for January topped 9 million tons, a 7% increase over last year. Shipments of petroleum totalled 5.4 million tons during January, a 6% y/y increase. Exports of petroleum were at 4.4 million tons for the month, a 5% y/y increase. Dry bulk cargo increased 45% y/y to 839,001 tons in January, while liquid bulk shipments increased 382% y/y to 100,772 tons.

GULF COAST PORTS POST MIXED RESULTS IN JANUARY

Container volumes slipped in Houston and New Orleans, while Corpus Christi was bolstered by crude oil exports. Cargo flow remained constant at ports in Houston and Corpus Christi, Texas, but slowed slightly in New Orleans due to lower breakbulk and container shipments during the month of January.

Concern rising over US West Coast labor pact

Uncertainty caused by almost eight months without a labor contract on the U.S. West Coast is resulting in investment decisions that could alter supply chains and end up costing the ocean carriers customers, according to a shipper lobbyist.