USDA OFFERS FUNDS FOR HOUSTON CHASSIS, TACOMA AG SHIPPERS

In a bid to assist US agricultural shippers move freight across crowded docks, the Port of Houston will receive federal funds to help add over 1,000 chassis to handle refrigerated containers, while Port of Tacoma exporters will get incentives for using a “pop-up” yard to stage their shipments. The two projects stem from the White House’s Supply Chain Task Force, the goal of which is to relieve the persistent port congestion affecting the US. Aim to exports. As part of those efforts, it would fund half the cost of buying 1,060 chassis for storing refrigerated containers at Houston. The funding, the amount of which was not disclosed, was set aside in

September 2021 through the USDA’s “farmer income support program. Unlike many other ports, Houston

does not have a racking system where refrigerated containers can be stacked and plugged in for power. Instead, it stores refrigerated containers on chassis. But chassis supply at the port has been severely affected by the US import surge, resulting in more containers being grounded rather than placed on wheels. The USDA said that results in extra container moves and strains the port’s power system for reefer cargoes. The decline in global vessel schedule reliability has become especially challenging for US agricultural exporters and has made it more difficult to schedule a delivery to Houston. The USDA said that the chassis will enable poultry, beef, and pork shippers to stage exports at the Houston docks ahead of being loaded onto ships. The agency added that the value of protein exports through Houston reached $500 million in 2021. “This partnership will ensure agricultural companies and cooperatives are able to export their commodities through the port and avoid costly delays or capacity constraints.

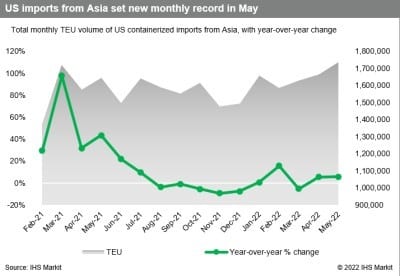

US IMPORTS FROM ASIA SURGE TO UNEXPECTED RECORD IN MAY

US imports from Asia set a new monthly record in May, demonstrating that despite the more than two months of covid lockdowns in shanghai and rising inflation in the United States, goods entered the us at an historic pace. west coast ports saw their share of Asian imports jump to 60 percent in May from 57.1 percent in April, a sign that ports on the east and gulf coasts were likely bumping into the limits of their capacity amid the record imports. the fresh data also interrupted the narrative that us retailers were

shifting their imports away from the west coast as a hedge against possible disruption linked to ongoing

longshore labor talks. Asian imports totalled almost 1.74 million teu in May, up 5.7 percent year over year and a huge 25.1 percent jump from pre-pandemic may 2019, according to piers. the 2019 comparison demonstrates that the baseline for us imports from Asia each month is now 20 to 30 percent higher than it was before covid-19 disrupted supply chains in the trans-pacific.

WEST COAST GAINS ALMOST ENTIRELY AT LA-LB

Los Angeles is the largest US port; the Los Angeles-Long Beach port complex in May set a monthly record of 851,956 TEU for Asian imports, according to PIERS, up 1.4 percent year over year and 9.3 percent higher than April. The spike in West Coast imports was almost entirely linked to Los Angeles-Long Beach. Asian imports to the Northwest Seaport Alliance of Seattle and Tacoma declined 11.5 percent in May, while Oakland’s imports from Asia increased just 1 percent. The East Coast’s share of US imports from Asia dropped to 33.5 percent in May from 35.9 percent in April, while the Gulf Coast’s share dropped to 6.3 percent from 6.7, according to PIERS. Congestion and vessel backlogs in a number of East and Gulf Coast ports demonstrated those gateways have a finite capacity for cargo diversions from the West Coast. Importers used to be able to shift all of the cargo they wanted