Trans-Pac vessel reliability ticked higher on US West, East coasts

Trans-Pacific carrier on-time performance to the US West and East coasts improved in March despite vessel backlogs at several US ports. But a disparity in the reliability gains showed how upcoming labour negotiations on the West Coast are affecting US ocean shipping dynamics. On-time performance also improved globally.

Charleston slashes anchored vessels to lowest of major US East Coast ports

The number of vessels anchored outside the Port of Charleston has been cut from 27 to five in the past two months after the South Carolina Ports Authority employed several efficiency measures involving berths, chassis, and trucks.

Charleston, which had the most vessels at anchor of any major port on the US East Coast two months ago, now has the fewest. That compares with Savannah at eight, and New York and New Jersey and Virginia, which each have nearly a dozen anchored vessels. South Carolina has also employed a modified “first-in, first-out” strategy with vessels whereby ships that take out more containers than they discharge can skip any line and berth in Charleston immediately, providing an incentive for ocean carriers to take out more containers.

Focusing on trucks, chassis

Charleston has been able to improve fluidity through its three container terminals due to close coordination with the trucking community.SC Ports has leased out nearly 800 chassis to trucking companies and beneficial cargo owners (BCOs) pending the launch of its proprietary chassis pool next spring. The port began receiving chassis for the pool from Dorsey Intermodal in January but leasing them now to truckers and BCOs allows movement of as many boxes as possible and lightens the constraints on the South Atlantic Chassis Pool, which Charleston remains a member of until its own pool launches. Sunday gate hours that went into effect in March and will run through the end of June have also helped create more space on the terminal. As many 1,000 trucks have visited the Wando Welch Terminal on some Sundays, and Melvin expects that number to remain consistent through the end of June. The extra hours on Sunday allowed the port to begin the week with terminal space available so it could quickly unload vessels early Monday morning, rather than wait until midday for trucks to remove a sufficient number of boxes

Port of Mobile approves APM terminal expansion

APM Terminals is a step closer to its goal of increasing container capacity at the Port of Mobile after the port’s board agreed to develop more land as part of a $100 million expansion project. Directors for the Alabama Port Authority voted last week in favour of a resolution that would add and develop another 32 acres to APM Mobile’s existing 115-acre footprint at the Choctaw Marine Terminal, according to meeting minutes. Approval of the deal comes as Mobile continues to see strong growth, with year-to-date volumes through March climbing 10

percent, according to the port’s presentation to the board. The terminal expansion, which will be on the terminal’s north side, will begin later this year. The first 19 acres are expected to be ready by 2024 and the remaining 13 by 2025.The port will issue $73 million of debt for the project, with APM on the hook for repaying $45 million of that debt, the project’s term sheet said. In addition, the Maersk subsidiary will also spend $30 million on two ship-to-shore cranes for the expansion. Mobile currently has four super-post-Panamax cranes. The resolution did not indicate how much capacity the project will add to Mobile, which can currently handle 650,000 TEU per year. But it’s known that APM wants to bring its capacity at the port up to 1.5 million TEU in the coming years. In March 2020, the port extended the berth to allow it to simultaneously handle two 8,000 TEU vessels. This year, the port expects to start another phase of dredging the port’s harbour to a 50-foot depth. In addition to larger ships, the port is readying for a major expansion of its intermodal rail capacity into the US Midwest. Last month, the port was awarded $200 million in federal funds that will be used toward both waterside and landside infrastructure.

Philadelphia call added to MSC’s India-USEC service

Philadelphia has its first direct service from India after Mediterranean Shipping Co. added the port to its weekly Indus 2 service to the US East Coast. The new rotation comes as MSC adds to its presence in the world’s second-most populous country. The first vessel in the new Indus 2 rotation, the 6,730 TEU MSC Michaela, arrived at Philadelphia’s Packer Avenue Marine Terminal on Wednesday, Phila Port said in a statement. Phila Port’s current vessel services include two from the South Pacific, three services from South America, one from Central America, three European services, and one from South Africa. Jeff Theobald, chief executive of Phila Port , said in the statement that shippers want more direct services rather than having to rely on transhipping from other ports.

Average delay falls sharply on West Coast

Another measure of the impact of increased cargo volumes at East Coast ports is the average delay experienced by late-arriving vessels. The average delay for those vessels landing on the East Coast from Asia ticked up by 0.89 days to 12.18 days. But delays to the West Coast for vessels arriving from Asia fell by a massive by 4.25 days to 12.22 days — the largest average month-over-month decrease in vessel delays of any of the 34 trade lanes that Sea-Intelligence tracks globally. In addition to the year-over-year decrease in import volumes, the largest West Coast gateway, Los Angeles-Long Beach, has been improving efficiency and reducing vessel delays by metering vessel arrivals through a joint program with the carriers and the Marine Exchange of Southern California. When a vessel operator leaves the last Asian load port, they book an arrival time and assurance of labour availability with the Southern California terminal where the ship will call. The operator adjusts the speed of the vessel enroute to Los Angeles- Long Beach so that the ship arrives at the designated time, rather than loitering close to shore. This reduces safety hazards in the harbour and cuts down on diesel emissions.

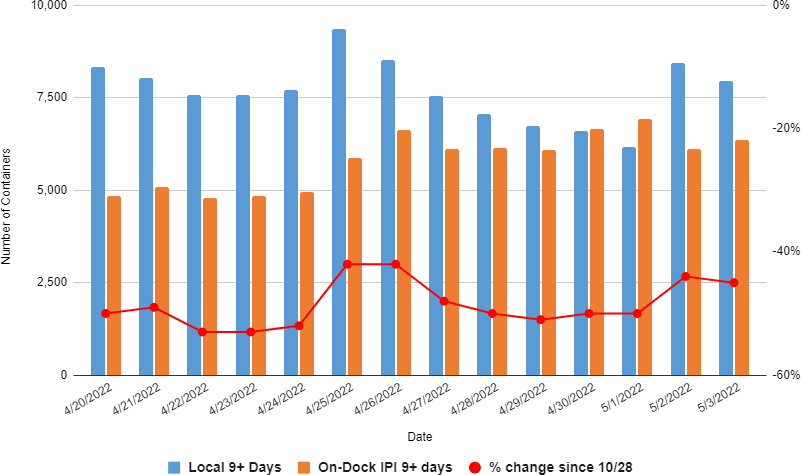

IMPORT DWELL REPORT

Long dwell import containers at POLB are down by 48% today as compared to Oct 28, 2021

This chart shows the number of containers at Port of Long Beach terminals meeting the criteria listed. Comparison date is Oct. 28, 2021, the last weekday before the container dwell fee began to be tracked.